Stock Rover

Strengths

- One of the most comprehensive stock screening platforms

- Integrates with your regular brokerage platform

- Offers both pre-built and customizable stock screeners

- Free plan available

- There’s no software to download

Weaknesses

- Stock Rover is not a trading platform

- There’s no dedicated mobile app

- Customer service is limited

In today’s complicated investment environment, you need more than just a good trading platform. A good stock screener is a must, especially if you are an active, self-directed investor.

Stock Rover is one of the best screeners and investment research services available. The wealth of research and analysis tools will help you to make more profitable investments.

And perhaps best of all, Stock Rover offers four separate plans, ranging from a free version with an impressive number of tools, to three different premium plans, each offering a progressively more advanced set of investment services.

Table of Contents

What is Stock Rover?

Stock Rover describes itself as “simply the best investment research platform on the web”. But is that is true?

Stock Rover is a powerful investment research and analysis tool. It is designed to exceed the capabilities of more traditional trading platforms, as well as other investment research sites. Stock Rover provides a high level of stock screening as well as research reports, charting, and portfolio performance metrics that are among the best in the industry.

But they list their comparison capability as their specialty. They’re able to compute fair values and margin of safety, as well as warn about important trends and analyze companies for quality, growth, value, and sentiment. (We’ll go into more detail on each of these capabilities in this review.)

The financial information provided on Stock Rover comes from several sources, including and especially under a licensing agreement with Morningstar.

How Stock Rover Works

Stock Rover offers four different plan packages, and each offers varying levels of the following five services:

Screening Strategies

Screening Strategies will help you find the best stock picks from the thousands available. They provide the usual metrics, like price-earnings and earnings per share growth, but they also accommodate custom screeners.

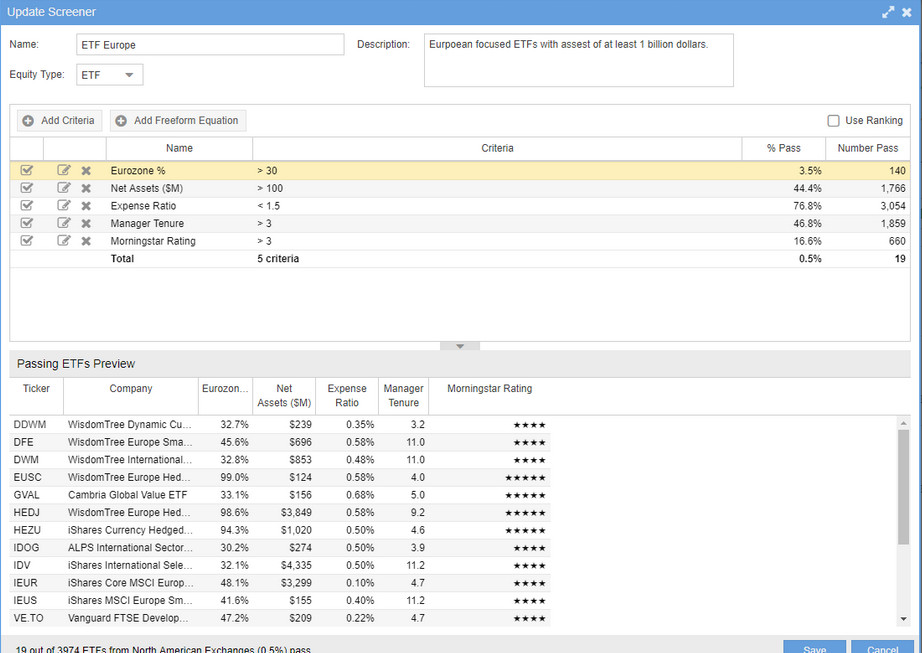

For example, you can screen stocks based on growth, value, or growth at a reasonable price (GARP), or for quality, momentum, dividend growth, or other metrics. The screener can screen any combination of more than 500 price, operational, financial, efficiency, and ratings metrics, and you can use both current and historical values.

Stock Rover offers more than 130 pre-built screeners, or you can customize your own. For example, you can create a customized ETF screener, selecting from nearly 200 different metrics:

Many of the metrics offered are incredibly specific. These include Guru Strategies, Piotroski F-Score (to determine the financial strength of a company based on nine criteria), Price to Graham Number, Price to Lynch Fair Value, Greenblatt Return on Capital and Earnings Yield, Shiller PE, Sloan Ratio, historical data equations, screener library, the cheapest large companies, momentum screener, and many more.

Stock & ETF Comparison

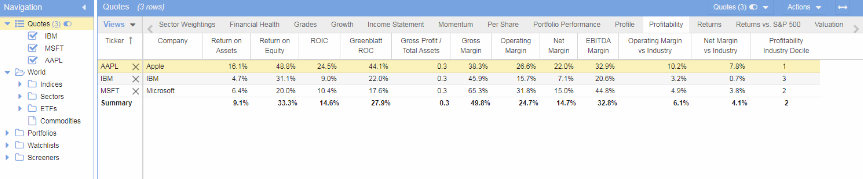

Stock Rover considers comparison to be their specialty. The entire feature works off the “Table”, which has the feel and function of an off-line spreadsheet program. It provides the ability to sort, filter, color rows, and add comments. It also allows you to pull out the most recent financials and pricing data and swap out databases with the click of a mouse.

You can add tickers to the table by loading datasets, then comparing the rows across hundreds of financial columns that can include any number of metrics, like growth, valuation, momentum, dividends, and historical returns. What’s more, the tables can be customized by adding, removing, or reordering them.

The feature comes with Stock Rover’s Insight Panel that provides fundamental data, financial statements, sales, earnings, cash flow, dividend analysis, analyst ratings, company news and other information. They use intrinsic value formulas to create a fair price for each stock.

This feature also includes investor warnings, stock ratings, data rich displays, comparative financial statements, dividend, insights, analyst ratings and estimates, and more than 650 financial, operational, pricing, and performance metrics

Research Reports

Stock Rover provides research reports on any of the more than 7,000 stocks they track. As a Research Reports subscriber, you’ll have unlimited access to up-to-the-minute research reports that can be viewed interactively in your browser or generated in a PDF. Reports include metrics like margin of safety, fair value, and Stock Rover scores.

Research Reports include at least a dozen analyses; ratings versus peers for growth, valuation, efficiency, financial strength, dividends, and momentum; detail given information, financial statements, valuation and profitability history, and any warnings for a particular stock, complete with an explanation.

Portfolio Management

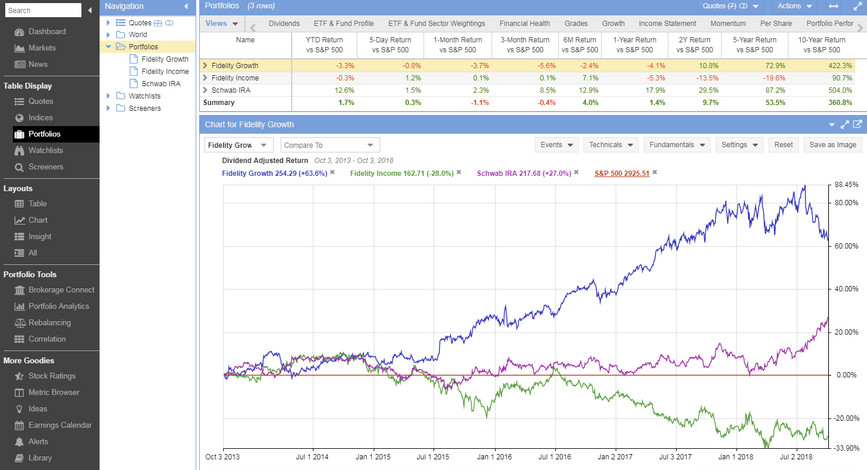

You can track your portfolio with detailed performance information, email performance reports, in-depth portfolio analysis tools, correlation, tools, training, planning, and rebalancing facilities. You can do this by importing your portfolios into Stock Rover, using their secure brokerage integration facility. Portfolio positions can be entered manually or with a spreadsheet import.

Portfolio Management comes with automatic portfolio reporting, portfolio analysis, test for correlation, and the ability to plan your next move. You’ll also be alerted whenever something important happens, which will take place by a text message or email. You can set triggers for specific alerts and receive notifications for events like a certain percentage change in a stock’s value, key price levels being reached, unusual trading volume, or upcoming earnings announcements.

If you are looking for portfolio tools specifically, check out the list of our favorite portfolio analyzers.

Stock Charting

Stock Rover offers stock charting controls that are both more capable than the competition, yet easier to use.

For example, portfolio charting will measure the performance of your portfolio against the S&P 500 index. You can also change the benchmark based on your own risk tolerance. It includes charting fundamentals that include more than 100 financial metrics. It will help with pair trading and comparing a particular company to its peers.

Charting also includes technical and events, like simple moving average, exponential moving average, Bullinger bands, moving average convergence diversions, relative strength index, candlesticks, ratio charts, and earnings surprise events.

Stock Rover Features

No geographic limitations: Stock Rover can be used anywhere in the US and from any country around the globe.

Customer service: Stock Rover doesn’t offer phone support or live chat. To access customer service you must use the extensive resources on the website itself, or email the support team at [email protected]. Users of the Free plan are not guaranteed an email response. Premium and Premium Plus members with yearly or two-year plans can add prioritized hotline telephone support for an extra $50 per year. Customer support is available on weekdays, from 9:00 am to 5:00 pm, Eastern time.

Mobile app: There’s no dedicated mobile app, but the Stock Rover platform can be accessed from an iOS or Android device.

Stock Rover security: Stock Rover exclusively uses the secure https protocol for transmissions between their servers and your browser. That means all network traffic is encrypted and cannot be decoded by unintended third parties on the web. Company servers also use multiple layers of firewalls, and access to information is limited to a small number of authorized users.

Stock Rover Pricing Plans

Stock Rover offers four different pricing plans, including one free plan and three premium paid plans.

Stock Rover Free – $0

As the plan name implies, this is Stock Rover’s free edition. But despite being free, it offers a surprising number of tools and features.

For example, it provides comprehensive information on more than 8,500 North American stocks, as well as 4,000 exchange-traded funds (ETFs) and 40,000 mutual funds. It also offers portfolio management and brokerage integration for automated syncing of portfolios.

This version also has powerful and flexible charting capabilities, daily analyst’s ratings with analyst rankings, in-depth market news, as well as news for individual stocks, and an informative market dashboard with a detailed display of markets and key stocks.

Stock Rover Essentials – $7.99

Essentials is the first of the three premium programs. It’s available for a monthly subscription fee of $7.99, or $79.99 per year – providing 12 months of service for the cost of 10. And if you want to save even more money, you can purchase the two-year program for just $139.99, which will lower the effective monthly cost to just $5.83.

Essentials comes with all the features offered in the Free version, but also adds the following:

- Easy comparison of investment candidates via the Stock Rover dynamic table.

- Fully customizable financial views and columns.

- More than 260 metrics with five years of detail historical data.

- Easy to use, fast, and flexible stock screening.

- Portfolio and watch list tracking.

- Brokerage integration for automatic syncing of portfolios.

- Real-time text and email alerting.

- Access to the Stock Rover Library or guru portfolios, advance screeners, and other tools.

- Full support from the technical team.

With the Essentials plan, you can maintain a maximum of 15 screeners, 10 portfolios, 10 watch lists, 25 views, and 100 tickers in a portfolio or watchlist.

Stock Rover Premium – $17.99

The Premium plan is available for $17.99 per month, or $179.99 if you pay for a full year. Once again, the annual subscription will provide you with 12 months access for the cost of 10. But you can also purchase a two-year subscription $319.99, which lowers the effective monthly cost to $13.33.

The Premium version comes with all the features and tools on the Essentials plan, but adds the following:

- 90 additional metrics, giving you a total of more than 350.

- More than 10 years of detailed financial history.

- Data export.

- ETF and fund comparison data.

- Powerful stock and ETF screening, as well as ranked screening.

- More than 100 chartable financial metrics.

- The ability to chart multiple metrics together, as well as auto data refresh capabilities.

- Advanced alerting with indices, portfolio, and watch level alerts.

- Detailed portfolio analytics.

- Future dividend income projections.

- Correlation analysis.

- Trade planning and rebalancing tool, with multi-monitor support, and detachable windows.

- Integrated comments and research notes facilities.

- Prioritized email support.

With the Premium plan, you can maintain a maximum of 25 screeners, 25 portfolios, 25 watch lists, 40 views, and 250 tickers in a portfolio or watchlist.

The Premium plan also is described as an ad-free experience, which would seem to indicate the Free plan does include ads.

Stock Rover Premium Plus – $27.99

Premium Plus is Stock Rover’s top-of-the-line plan, incorporating all the best tools, features, and services the company offers to investors. It’s available for a subscription rate of $27.99 per month, or $279.99 per year. Once again, the annual subscription will give you the equivalent of 12 months of service for the cost of 10. But you can also purchase a two-year subscription for $479.99, which will work out to be just $20 per month.

Stock Rover Premium Plus comes with all the features of the Premium plan, but adds the following:

- More than 300 additional metrics, for a total of over 650.

- Customizable metrics.

- Equation screening and historical data screening.

- Stock ratings, stock fair value, and margin of safety.

- Current and historical stock scoring for growth, value, quality, and sentiment.

- Investor warnings.

- Ratio charts.

- Much higher data limits, including brokerage connections, portfolio, watch lists, screeners, and more.

- Prioritized email support.

With the Premium Plus plan, you can maintain a maximum of 60 screeners, 60 portfolios, 60 watch lists, 60 views, and 600 tickers in a portfolio or watchlist.

Stock Rover Pros & Cons

Pros:

- Stock Rover is one of the most comprehensive stock screening platforms in the industry.

- Integrates with your regular brokerage platform.

- Offers both pre-built and customizable stock screeners.

- Choose from one of four plan levels, including a free version.

- There’s no software to download, Stock Rover works on your web browser.

Cons:

- Stock Rover is not a trading platform, but it can be integrated with a third-party broker.

- There’s no dedicated mobile app, but you can access the platform from your mobile device.

- Customer service is complicated. Contact is by email only, but users of the Free version are not guaranteed a response. Members of the Premium and Premium Plus plans can have access to a telephone hotline, but there’s an extra $50 fee for the service.

Should You Sign Up with Stock Rover?

If you’re an active investor, and especially if you are a frequent trader, a good stock screener will make you a better trader and increase your returns. Stock Rover is one of the best available, and it has the advantage of allowing you to choose the plan level that will work best for your investing activities.

You can start out using the free version, and once you outgrow that, you can move up to Stock Rover Essentials. Eventually, you may find yourself using the Premium or Premium Plus plans to gain access to even greater research, analysis, and investment tools.

Stock Rover provides that kind of flexibility and level of investment knowledge needed to become a more successful investor. And if you’re a really serious investor, the Stock Rover Premium Plus plan can give you all the resources available to professional traders at well below $30 per month. That’s a small price to pay for best-in-class investment information.

If Stock Rover isn’t for you, or you want to check out the alternatives, here are the best stock screeners.