Imagine that you can save and invest money every time you spend money. Does that sound too good to be true? It is true, if you use a smartphone app known as Acorns. Acorns uses a concept known as virtual spare change, that enables you to save and invest money with each purchase that you make. It’s a good app if you have had difficulty saving money in the past.

But Acorns doesn’t just enable you to save money.

It also invests that money for you.

The virtual spare change that’s accumulated in your account is invested in a portfolio of professionally managed stocks and bonds. In this way, Acorns makes both saving and investing money an automatic process. You do what you’ve always done and Acorns does the saving and investing.

Do you like getting free shares of stock? We have this list of financial startups that give you shares for signing up for their service. Companies like Robinhood, and Tornado!

Table of Contents

What is Acorns?

Acorns is part micro-savings platform and part robo-advisor. It’s an app that you install on your smartphone, that enables you to both save money, and then invest in a professionally managed investment portfolio.

There are now dozens of robo-advisors available, but where Acorns differs is in how you fund your account. Rather than making flat dollar deposits into your account, or even setting up payroll deductions – both of which you can also do with Acorns – you fund your account through your spending behavior.

Each time you make a purchase, the amount of the purchase is rounded up to the next dollar amount, and the difference between the rounded up payment and the actual purchase price of the product or service that you are buying goes into your investment account.

This enables you to save and invest money every time you make a purchase. In a real way, it means that you become wealthier as you spend money.

How Acorns Works

The Acorns app is free to download. When you add the Acorns app to your smartphone, you link your spending accounts in the app. That includes your checking account, PayPal account, and credit cards. Any time you spend money using any of the linked accounts, Acorns will create what are known as “Round-Ups.” That’s the difference between a predetermined rounded up dollar amount and the actual purchase price of the product or service that you are buying.

You are always free to fund your Acorns account with either lump-sum deposits or automatic payroll deductions, but Round-Ups are the preferred method.

You can choose how you want to round up your purchases. For example, you can choose to round up your purchases to the next dollar, or to the next $10. If you round up to the next dollar, a purchase of $1.57 will charge your account $2.00, with $0.43 going into your acorns investment account.

If you set the Round-Up to the nearest $10, a purchase of $8.25 will charge your account $10, with $1.75 going into your acorns investment account. Naturally, the higher the Roundup threshold is the more money that you will be allocating for investing.

Each time the Round-Up accumulates $5, the money is transferred into your investment account. Within the investment account, your money is invested in a predetermined investment portfolio, that is invested in a group of exchange-traded funds (ETFs). This gives you the benefit of professional investment management, as well as a completely passive and automatic way of saving the money that will go into the account.

Acorns “Found Money” Feature

Acorns is working with beta partners who will contribute cash back to your Acorns investment account when you shop with them. The cashback will typically appear in your investment account within 30 to 60 days of your purchase.

Acorns is currently working with 40 different beta partners on this project.

The partners/merchants include (but are not limited to):

- Casper (mattresses)

- Jet (online shopping)

- Hotel Tonight

- Blue Apron (meal packages delivered to your home)

- AirBNB

- Boxed (online grocery)

- Hulu (our review)

- Dollar Shave Club

- Warby Parker (eyeglasses and sunglasses)

- ProFlowers

- Macy’s

- New Balance

- Nordstrom

- Rover.com

- Boxed

- Walmart

- Stitch Fix

- and more

If you plan to make any purchases from the categories represented by these merchants, you can simply buy what you need through them, and the cashback that they offer will find its way into your investment account. That’s a double-edged benefit – vendor cashback, plus the normal Acorns Round-Up.

The Acorns Investment Portfolio

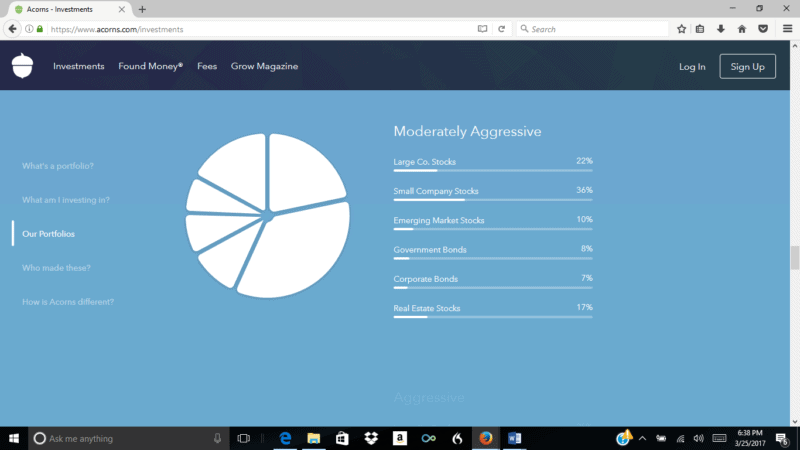

Acorns investment portfolio works similar to other robo-advisors. Your account is invested based on modern portfolio theory, MPT, which considers diversification into different asset classes to be more important than individual security selection.

In that way, Acorns can build a well diversified portfolio by investing in just six asset classes: large companies, small companies, emerging markets, government bonds, corporate bonds and real estate stocks.

They do this by investing in six ETFs that correspond with each asset class. The ETF’s are provided by Vanguard, PIMCO and Blackrock.

Those ETF’s currently include:

- iShares IBoxx $ Investment Grade Corp Bond Fund (LQD)

- iShares 1-3 Year Treasury Bond ETF (SHY)

- Vanguard Small-Cap Index Fund ETF Shares (VB)

- Vanguard REIT Index Fund ETF Shares (VNQ)

- Vanguard 500 Index Fund ETF Shares (VOO)

- Vanguard Emerging Markets Stock Index Fund ETF Shares (VWO)

Your portfolio is determined by your age, your investment goals, your time horizon, your income and your risk tolerance. Considering all these factors, Acorns then determines your portfolio to fit into one of five different portfolio classes:

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

Each portfolio contains a different mix of ETF allocations. For example, the Conservative portfolio is 60% in bonds and 40% in stocks. The Aggressive portfolio is 100% invested in stocks, with no allocation for bonds. The other three portfolios contain a mix of asset classes that is somewhere in between the two extremes.

Once your portfolio has been established, you always have the option to change the allocation. For example, if the app determines that you have a Moderate profile, you can always choose to change your allocation to Moderately Aggressive to add a stronger growth potential.

As a robo-advisor, Acorns also offers automatic rebalancing of your portfolio whenever it begins to move outside of the original allocation. They also provide automatic reinvesting of dividends back into your portfolio, again based on the specific portfolio allocation.

The use of ETF’s actually enables you to be diversified across literally thousands of different stocks and bonds, even with a very small investment portfolio. But it also provides you with low-cost, professional investment management, the kind that people often pay thousands of dollars per year to have.

✨ Related: Apps Like Acorns

Acorns Fees

The Acorns app used to be free but like other microsaving apps, they now charge you $1 per month for balances under $5,000. Those above $5,000 will pay a 0.25% annual fee. The fees that they charge apply to your investment portfolio balance. Normally, when you have traditional investment management, you can expect to pay 1% or more of the balance held in your account. What’s more, professional investment managers often have steep minimum account balance requirements, such as $500,000 or more.

Acorns has no account minimum – you can open your account with no money at all. And their fees are just a fraction of what traditional investment managers charge.

Acorns actually has three different fee structures:

- Account balances under $5,000, $1 per month

- Accounts balances over $5,000, 0.25% of the account balance

- Students invest for free for 4 years from date of registration

Based on this fee structure, you can have a portfolio of less than $5,000 professionally managed for $12 per year. A $10,000 portfolio would be managed for just $25. And of course, if you are a student, your portfolio will be managed for free. Acorns loves students, considering them to be next-generation investors.

(To be considered a student, you must list your occupation as a student, be under age 24, and sign up for your account with an email address that ends with .edu.)

Apart from the management fees listed above, there are no other fees.

Signing Up With Acorns

You can sign up for the acorns app through either the Apple App Store or on Google Play, and once again, it’s free to install.

Sign up will involve providing the following information:

- A valid email address

- Your online banking login information to link your accounts to Round-Up spare change and to fund your investments.

- If you don’t bank with Bank of America, Chase, Citibank, PNC Bank, USAA, US Bank, US Navy Federal Credit Union, or Wells Fargo you’ll also need your checking account and routing numbers.

- Your physical address–this should be your most permanent address since they can’t accept PO Boxes or business addresses.

- Your Social Security Number.

- General Profile Information like your financial goals, occupation, and earnings. This will help in recommending the right portfolio for you.

- Upload a photo of your government-issued ID or other documentation that helps them verify your identity.

Once you’re signed up with the app, you can add as many spending accounts as you like and you’ll be ready to go.

Should You Give Acorns a Try?

It really depends. If you are serious about saving money and investing it, Acorns doesn’t do enough. Saving a few cents here or there, then paying $1 a month for the pleasure, doesn’t make a lot of sense. Even if you get above $5,000, paying the 0.25% (which is more than $1 a month), doesn’t change the economics.

Acorns is a useful app if you have difficulty saving and investing money but you pay a premium for it. It makes the entire process automatic, from saving and accumulating investment funds, to actually handling the investment activity in your account.

All you need to do is set your Round-Ups and your connected spending accounts, determine your portfolio, and Acorns handles the rest. That includes investment selection and management, account rebalancing, and even dividend reinvesting.

Acorns offers value but comes at a small cost, comparable to other similar apps.

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value.

*Offer is subject to T&Cs

George says

Good advice. I’ll give it a try. Thanks for offering.

Nate says

One other thing worth mentioning is they sporadically increase their referral bonus. They did +$500 if you refer 10, I believe in November, and this month they actually have $1000 if you refer 10! On top of the normal $5 for you and for the person being referred.

Judy says

I closed my Acorns account after less than two years. It was up 23% which was excellent, but my deal breaker was their timeliness of sending my tax info. Last year it was the middle of March and that is what they aim for.

Carlos Garcia says

DO NOT INVEST YOUR SPARE CHANGE WITH THESE THIEVES, ACORNS…BETTER TO PUT YOUR MONEY IN YOUR SAVING ACCOUMT, BUY BITCOIN OR SIMPLY BUY TAX LIEN CERTIFICATES, BUT DON’T WASTE YOUR MONEY HERE: AFTER A YEAR, AND DESPITE THE LOW FEDERAL APR, YOUR MOMEY WILL NOT GROW BUT DISAPPEAR.