Mainvest

Strengths

- A low minimum initial investment of just $100.

- Invest in small, local businesses as an alternative investment

- The Mainvest chat room to connect with business owners

- Your liability is limited to your investment

- Accredited investor status not required

Weaknesses

- Investments are vulnerable to economic slowdowns and recessions.

- Investments are high risk and are not FDIC, or SIPC protected.

- No mobile app

Are you struggling to find ways to diversify your investment portfolio? Mainvest offers investors an opportunity to spread their wings by investing in small, local businesses for as little as $100. Mainvest uses a crowdfunded investment model in which investors provide financing for small businesses in exchange for regular interest income. In this Mainvest review, I’ll cover the basics, show you how to sign up, and tell you who I think Mainvest is best suited for.

Table of Contents

What is Mainvest?

Mainvest – a play on the concept of investing in America’s “Main Street” – allows investors to generate passive income streams by investing as little as $100 in small businesses. The company claims target returns ranging between 10% and 25% per year, with business opportunities across the country.

According to Mainvest, the company has raised $12 million in capital for over 400 investment opportunities. They also claim more than 96% of businesses are on track with their repayments.

The company’s mission is to help small businesses and local communities get the financing they need to keep their businesses running. They specifically target loan applications from small businesses owned by female and minority entrepreneurs. The goal is to reverse the trend of national retail chains and e-commerce giants putting family-owned companies out of business.

Based in Salem, Massachusetts, Mainvest was launched in 2018. The company currently has a Better Business Bureau rating of A+, the highest rating on a scale of A+ to F.

Mainvest Features & Benefits

Minimum investment: $100 in most cases, though the business you are investing in may have higher minimums.

Accredited investor requirement: No

Investments offered: Loans to small businesses.

Available accounts: Taxable investment accounts, IRAs

Mobile App: Not offered

Customer service: Phone or email, hours of operation are unclear.

How Mainvest Works

Mainvest presents investment opportunities in highly vetted small businesses for investors on the platform. The focus is on breweries, restaurants, bakeries, and specialty retail shops. Mainvest claims more than 10,000 investors have invested in the platform.

The minimum investment is $100. Investors purchase revenue-sharing notes with specific maturity dates. The business’s gross revenue determines the rate of return on each note and the percentage of revenue shared with investors each quarter. The larger the investments made, the greater the percentage of business revenue the investor can earn.

Most investments on the platform are debt-based, so you can expect repayment of your investment, as well as the interest earned on it. Some of the investments offered are equity-based and offer higher potential returns at a higher risk level.

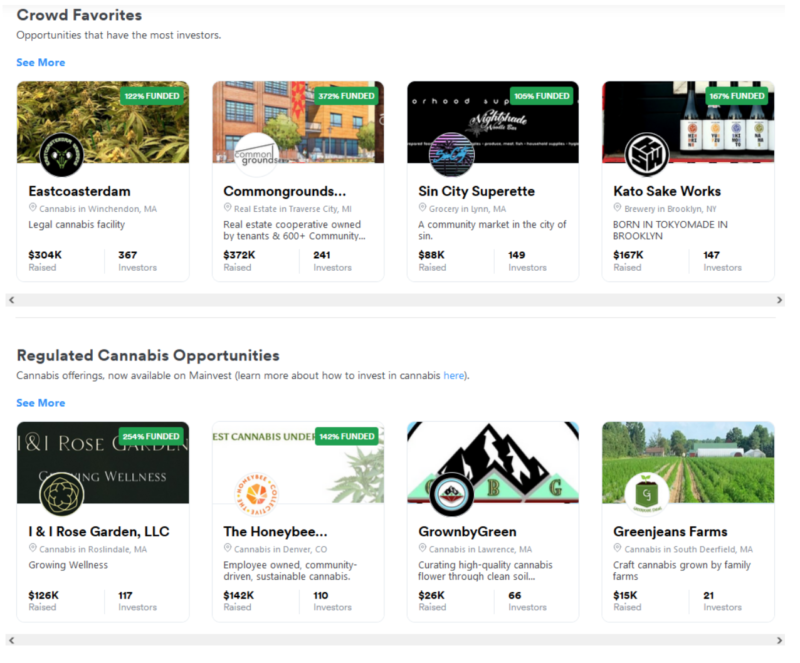

There are currently scores of potential investments on Mainvest, some of which include:

You can view the investment goal, how much money the business has collected, and the number of investors who have provided financing for each opportunity. Each will also display the number of days remaining in the funding term and payback, typically between 1.5 and 2 times the amount invested.

You can further navigate into each investment offered. For example, you can navigate to financial information, business plans, risk factors, certain SEC filings, and other information.

Mainvest also has a chat room to ask questions directly to business owners.

NOTE: Mainvest does not act as a financial advisor, and they cannot guide you towards the ideal investment. You should consult with your own financial or investment advisors if you’re unsure about any investment decision you are about to make.

Tracking Your Investments

Mainvest has a dashboard to keep track of any investments you make on the platform.

Security

Mainvest uses secure sockets layer (SSL) to create an encrypted link between your browser and their servers.

Due to the status of Mainvest investments as unregulated/alternative investments, no insurance coverage is available from either FDIC or SIPC.

In some cases, business owners will provide a personal guarantee or even pledge collateral as security for your investment. While this step is not required of business owners by Mainvest, some may offer the security to make their funding requests more attractive to investors.

You should carefully examine and evaluate the paperwork connected with each investment to determine if the business owners’ are offering any security arrangement. Naturally, investments that will not involve business owners’ security will carry higher risk.

Cancelation

If you subscribe to an investment in a business, you can generally cancel any time up until 48 hours before the offering deadline set by the company. You can also withdraw your subscription if there is a material change in the offering during the investment term.

Early Withdrawal

As is typically the case with any crowdfunding investment opportunity, you won’t be able to liquidate your investment before the end of the term. No secondary market is available to sell investments early.

The Mainvest Vetting Process

For small businesses to qualify for investment funds through Mainvest, they have to meet specific criteria before Mainvest can list their requests on the platform.

At a minimum, a business must raise at least $10,000 from 10 people they know personally to be eligible to request funds on Mainvest.

Otherwise, Mainvest uses five-point criteria to get businesses:

Anti-Fraud Vetting. Though the company maintains that the process can never be 100% certain, they strive only to accept businesses that won’t raise the risk of fraud or other investor protection concerns. The offering and business owners requesting it must appear capable of managing investor funds and can not have been disqualified for an offering under regulatory crowdfunding.

Responsibility Check. Company staff will engage business owners through a series of phone calls, emails, and direct contact. Any communication difficulties concerning social media activity or missing rounded financials can cause rejection of funding for the business.

Bad Actor Check (BAC). This process involves performing a limited background check through a reputable third party. The review is done on the business, its managers and officers, and anyone who owns 20% or more of the company. It focuses primarily on regulatory disqualification provisions available from publicly filed sources, like liens or lawsuits.

Yellow Flag BACs. This step involves a review of public records – everything from traffic citations to lawsuits. Funding may go forward based on the accuracy and findings surrounding any issues.

Continuous Review. Vetting with Mainvest is a constant process. Even after the business has been accepted for funding, Mainvest continues to review additional information as it becomes available. Negative information is analyzed to determine any investment risk or potential fraud.

Mainvest Fees

There are no fees for investors to join Mainvest. Mainvest does collect a fee on each financing deal arranged on the platform. But that fee is paid by the business owner, not by investors.

How to Sign Up with Mainvest

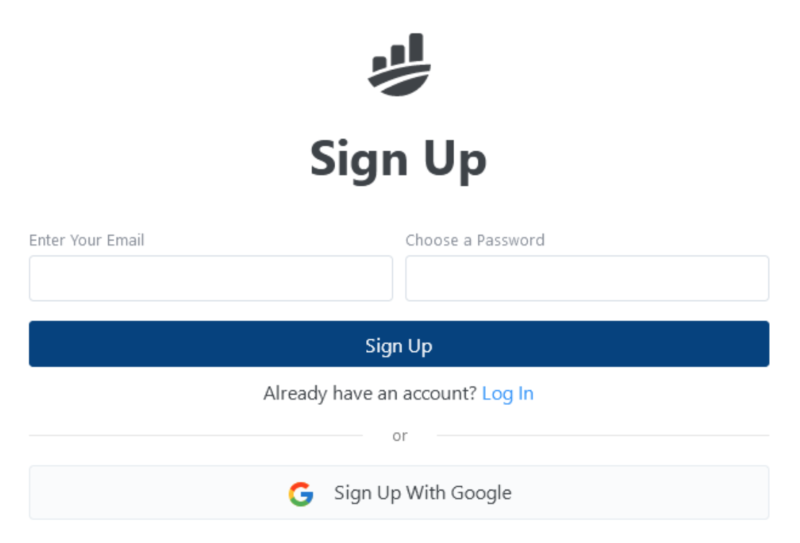

Anyone can sign up to join Mainvest, providing they are of legal age in their state of residence and has a U.S. bank account. There is no requirement to be an accredited investor to invest with Mainvest.

You can sign up directly from the website (there is no mobile app to sign up on) by entering your email address and creating a password. Alternatively, you can sign up using your Google account if you have one.

To fund investments in your account, you will need to link your primary bank account to Mainvest. Mainvest will hold your funds in escrow until the project you want to invest in is fully funded. If the project falls through, Mainvest will return your money to you in full.

Mainvest Pros & Cons

Pros:

- A low minimum initial investment of just $100

- Invest in small, local businesses as an alternative investment

- The Mainvest chat room to connect with business owners

- Your liability is limited to your investment

- Accredited investor status not required

Cons:

- Investments are vulnerable to economic slowdowns and recessions.

- Investments are high risk and are not FDIC, or SIPC protected.

- No mobile app

Should You Invest with Mainvest?

Mainvest offers investors an opportunity to invest in small, thriving businesses that need additional financing to grow. It’s a chance for investors to fight back against large chain organizations and support small businesses instead.

The company does advise that these are high-risk investments. Even though you can make small investments of as little as $100 in each business, the possibility of losing your entire investment is real.

But you can invest a small amount of money, which means you can spread a $1,000 investment across ten different businesses. And there’s no need to be an accredited investor to participate.

If you want to invest on a local level, Mainvest may be an excellent opportunity to carve a small space in your stock portfolio to include small business financing. It will also allow you to invest in businesses you’re familiar with, which may enable you to identify more profitable investments.